General

When is the 2026 annual enrollment election period?

Annual enrollment will run from Monday, Oct. 27, 2025, through Sunday, Nov. 16, 2025. This is your yearly opportunity to review and make changes to your benefit elections for the 2026 plan year (Jan. 1, 2026, through Dec. 31, 2026).

All changes will be effective Jan. 1, 2026.

In 2026, we are focusing on balancing the rising costs of healthcare while continuing to offer robust, comprehensive options for our associates. We have also prioritized simplifying your healthcare experience and clarifying the offerings Nemours provides. You shared that benefits here at Nemours can seem complicated—we’re listening, and we’re already making changes to make things easier to understand.

Key updates for 2026 include:

- Medical plans: We have renamed our medical plans to be more descriptive and easier to understand. You will see new names such as High PPO, EPO, Mid PPO, and Low PPO with HSA. Associate contributions will increase slightly to keep up with rising healthcare costs, ranging from $2 to $17 twice monthly for full-time associates with Wellness discount, depending on the plan and coverage tier.

- Dental plans: We have also renamed our dental plans to be more descriptive and easier to understand. You will see new names such as Premier with Ortho, Complete with Ortho, and Basic Care. Associate contributions will increase nominally, ranging from $0.16 to $2 twice monthly, depending on the plan and coverage tier.

- $0 copays: Free virtual urgent care visits via Teladoc and telemedicine visits through the Nemours Children’s MyChart app as well as free pediatric primary care, specialist, and mental health visits at Nemours Children’s providers (except Low PPO with HSA plan).

- Ultasounds and MRIs: Added to preventive breast cancer screenings at no cost.

- New weight management support: Personalized weight management assistance through Vida Health, including GLP-1s, lifestyle changes, medical guidance, and health coaching.

- Expanded pharmaceutical savings: We’ve partnered with Rx Savings Solutions to help you save money across all types of prescription drugs.

- Tobacco surcharge removal

- New leave of absence administrator: Lincoln Financial Group will make it easer to access help when you need it most.

- New insurance cards: All medical plan participants will receive new, simplified insurance cards for the 2026 plan year.

- Improved support: A range of new communication tools and support resources, including in-person Nemours Benefits Fairs and a new chatbot, will be available to assist you.

You are only required by the Internal Revenue Service to make your annual dollar election for the Flexible Spending Accounts (FSAs) — including both healthcare and dependent care. You also need to re-enroll in the SAVI plan. However, it is important for all associates to actively participate in annual enrollment to ensure your coverage selections are up-to-date and reflect your needs for 2026. This allows you to confirm your elections, add or remove dependents, and review the new and updated benefits.

You do not need to re-enroll in the Nemours Children’s Retirement Plans (403(b) and 457(b) plans).

We know how busy you are working and caring for others, so we’ve provided additional time for annual enrollment this year. You may begin enrolling as early as Monday, Oct. 27, 2025, and have through Sunday, Nov. 16, 2025, to review, submit, save, and print your enrollment confirmation. Please note: You will not have another opportunity to make changes to your benefits unless you experience a qualifying life event (QLE)—such as a birth, death, divorce, marriage, loss of benefits coverage via a spouse, etc. In such cases, you have exactly 30 days from the date of the event to contact Nemours Benefits Enrollment at 888.624.2387 to initiate the change.

This year we have additional enrollment support. Benefits counselors will be onsite at the main locations, and there is a call center for assistance. This will provide a personalized education enrollment session. Benefits counselors will review your options, help answer your questions, and assist with getting you enrolled. To schedule an appointment, click here.

If you don’t go through the enrollment process, your 2025 elections will carry over into 2026.

However, if you participate in any of these benefits, you will need to re-elect:

- SAVI (requires you to re-attest your eligibility to continue this benefit)

- Flexible Spending Accounts (health care, limited purpose, dependent, mass transit and parking)

- If you are enrolled in the HRA, you will need to verify your continued eligibility by Nov. 30, 2025

Upon completion of your online enrollment, a confirmation statement will be provided for you to save, email or print. In addition, you will receive an email following the end of the enrollment window with instructions on how to access your confirmation statement. Please check your confirmation statement carefully. If you need to make any changes after enrollment closes, please email [email protected].

If you have a status change or qualified life event (QLE) in the last quarter of 2025 (during or after annual enrollment), you will need to make benefits elections for both 2025 and 2026 for your benefits changes to carry over for 2026. You may make both elections either through the enrollment portal or by contacting Nemours Benefits Enrollment (888.624.2387) for assistance.

Benefits Changes and Enhancements in 2026

What is the difference between Nemours Benefits Support and Nemours Benefits Enrollment?

Nemours Benefits Support is our “front door” for benefits. Our navigation and advocacy partner assists with benefit plan questions, finding in-network providers, precertification, claims questions, and more. Nemours Benefits Enrollment is our benefits administration and technology platform that houses our online benefits enrollment portal as well as helpful decision support tools.

Medical Coverage

Why have the medical plan names changed?

The previous plan names, which were color-based, did not clearly describe the medical plan types or their network features. The new names (High PPO, Mid PPO, EPO, Low PPO with HSA) are standard industry terms that better reflect the plan’s design and features. This change makes it easier for you to understand your coverage and compare your options effectively.

How do the new medical plan names correspond to the old ones?

Here is a quick reference guide to help you understand the changes:

- Red plan is now the High PPO

- Blue plan is now the EPO

- White plan is now the Mid PPO

- Green plan is now the Low PPO with HSA

- SAVI plan remains the same

Can you help me understand the new medical plan types?

To help you select the best plan for you and your family, here are the key definitions for each plan type:

- PPO (Preferred Provider Organization): This medical plan offering gives you the flexibility to see any provider, in or out of network. You’ll pay less when you stay in-network or go to a Nemours Children’s provider, where applicable, but out-of-network care is still covered.

- EPO (Exclusive Provider Organization): This plan offers coverage only when you use doctors and hospitals within the plan network (except for emergencies). You do not need referrals to see specialists.

- Low PPO with HSA (High-Deductible Health Plan with a Health Savings Account): This is a qualified high-deductible plan that lets you save pre-tax money in a HSA to pay for eligible medical expenses. Nemours also contributes funds ($250 for single / $500 for family coverage).

- SAVI: This plan is available if you have access to eligible, alternate qualified medical and prescription drug coverage. If you qualify and enroll annually, there is no premium contribution, and it pays 100% of out-of-pocket eligible costs.

Why am I receiving a new medical insurance ID card, even if I’m not making any changes?

To ensure a smooth transition into the new plan year and to minimize confusion, we are issuing new medical insurance cards to all associates enrolled in a Nemours Children’s medical plan. Even if you are keeping the same plan, the new card will be updated for the 2026 plan year (effective Jan. 1, 2026). This helps ensure providers and administrators have the most up-to-date information when you access care.

Your ID card is also available anytime on the Nemours Benefits Support app or by logging into the portal. If you want to order more, you can also do that through the app or online.

When will my new insurance card arrive?

New cards will be mailed to your home address in December 2025. Please allow some time for delivery as it will be sent to your address on file as soon as administratively possible. Once you receive your new card, please securely destroy your old one.

Will the Health Reimbursement Account (HRA) continue for 2026?

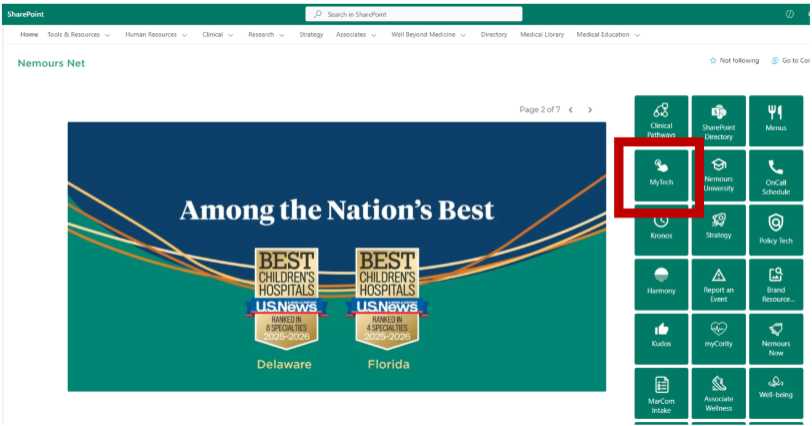

Yes! Nemours is again offering an Income-based HRA for associates who qualify based on household income. Eligible associates must enroll in either the High PPO, the EPO, or the Mid PPO plan and complete the HRA application found on the bottom left-hand side of the Nemours Benefits Enrollment portal. You will need to create an HR Help Center Ticket (in MyTech) with the benefits category. When you open your ticket, don’t forget to upload your 2024 tax returns with the application; more information is available here. Those who apply will be notified via your MyTech ticket once your application and required documentation have been reviewed, and a determination has been made. Applications and documentation are due by Nov. 30, 2025 — additional details in the FSA, HSA & HRA section below.

If I had the HRA in 2025, do I need to do anything to continue eligibility for 2026?

Yes. You will need to submit a new HRA application and your 2024 tax return via MyTech to determine your continued eligibility. Applications and documentation are due by Nov. 30, 2025.

Will fertility benefits continue to be offered in 2026 and are they available in all four plans?

Nemours continues to provide comprehensive and inclusive family-forming benefits including fertility benefits (through Progyny) and additional pregnancy, maternity, and parenting support resources (through Cleo). The benefit design allows you and your doctor to pursue the most effective treatment and provides coverage for two smart cycles per lifetime. These fertility benefits are available in all four medical plans and are subject to your deductible and coinsurance.

What if my spouse’s employer offers benefits?

If you are currently enrolled in a Nemours plan but can enroll in your spouse’s plan (non-Nemours), you will want to consider our SAVI plan. Your Nemours premium for SAVI is $0, and it will pay 100% of the eligible out-of-pocket costs incurred from your spouses’ medical plan up to the Affordable Care Act (ACA) maximums (2026 limits are $10,600/single and $21,200/family per year).

Note: SAVI is available to currently enrolled associates, spouses and children who move to the spouse’s plan (except for TRICARE, Medicare, Medicaid and HSA plans). You and your spouse should weigh which plan works best for your circumstances. This benefit is also open to associates who are covered by a parent’s medical plan (non-Nemours). More information is available in the Resource Library including eligibility requirements.

I was enrolled in SAVI in 2025. Do I need to do anything to continue coverage in 2026?

Yes. You must re-attest your eligibility for 2026. If you miss this step, you and your eligible dependents enrolled in 2025 will be removed for 2026.

What is the spousal surcharge for 2026?

The spousal surcharge will continue to be $300 per month. This surcharge is applicable only when your spouse has access to medical coverage through his/her/their employer, and you decide to cover him/her/them through a Nemours medical plan.

- If your spouse is not covered by Nemours, there is no spousal surcharge.

- If your spouse is a Nemours associate, there is no spousal surcharge for either one of you.

- If your spouse has access to medical coverage from his/her/their employer, you can avoid the spousal surcharge and lower your out-of-pocket costs by enrolling in the SAVI plan, if eligible.

Note: You are required to update the status of your spouse’s coverage availability during annual enrollment as part of your SAVI re-attestation.

Which of the plans has the most tax advantages?

The Low PPO with HSA (previously the Green plan) includes a Health Savings Account (HSA). An HSA offers a triple tax advantage to those who enroll in it. Associates can contribute tax-free funds, earn tax-free interest on their investments, and use the funds for eligible medical expenses tax free. Nemours also contributes to your HSA.

Are there other medical coverages that can help me save money?

Associates and their family members enrolled in one of the medical plans have access to several speciality care and support benefits that can help you save money. A few examples include:

- 2nd.MD provides virtual medical consultation and navigation services that connect you virtually with board-certified, elite specialists about your diagnosis or treatment plan all within a matter of days at no cost to you.

- Carrum Health connects you to top Surgery Centers of Excellence for procedures such as knee, hip, shoulder, spine, heart, and weight loss surgeries. Using the Centers of Excellence is optional, but for those who choose to do so, your out-of-pocket costs will be lower and the cost of travel, if necessary, will be covered.

- Twin Health offers services to help with reversing Type 2 diabetes, and Hinge Health offers virtual exercise therapy services. There is no cost for you to use these benefits.

Understanding Rising Healthcare Costs

Is the cost of our benefits increasing for 2026?

For full-time associates, associate payroll contributions for the medical/pharmacy and dental plans are increasing slightly; for example, depending on plan selection, medical/pharmacy rates with Wellness are increasing from $2 to $17 twice monthly. Twice-monthly dental premiums will increase by $0.16 to $2 pre-tax, depending on the plan and who you cover. Vision plan contributions will remain unchanged.

Why are my premiums increasing?

We want to be transparent about the significant challenge of rising healthcare costs. Like many organizations, Nemours has experienced consistent double-digit annual increases in medical and pharmacy costs. These increases are driven primarily by high utilization of medical services and prescriptions, including newer, high-cost medications. We will continue to cover the majority of benefits costs for associates, which is about 85%. We’re committed to managing costs wherever possible to continue offering comprehensive benefits while minimizing the financial impact on our associates.

How is Nemours addressing the high cost of healthcare?

Our team is focused on proactively navigating the high cost of care and finding sustainable solutions. This is why we have continued to leverage and enhance programs to provide robust options to help lower costs for our associates and improve health outcomes.

Examples include:

- Expanding virtual care: Making Teladoc urgent care visits and Nemours pediatric telemedicine visits free help reduce the cost of care.

- Negotiating with providers: We continue to work with our plan administrators and provider network to secure the best possible rates.

Prescription Coverage

Which company do we use for prescription drug benefits?

Express Scripts, the country’s largest pharmacy benefit manager, will continue administering pharmacy benefits in 2026.

Express Scripts also offers a copay assistance program called SaveOnSP that works with you to apply manufacturer-sponsored copay assistance for certain specialty medications. Associates can potentially pay $0 for their specialty medications after all funds are applied. Please note the applicable amount of copay assistance does not count toward deductibles or meet out-of-pocket maximum.

We are also implementing Rx Savings Solutions (RxSS) to help you save money on prescriptions. This voluntary program sends personalized alerts when there is a lower cost prescription available—such as switching to a generic, using a different pharmacy or using tablets instead of capsules. Both SaveOnSP and RxSS aim to make medications more affordable through more transparency and smart savings.

What does our prescription drug program cover?

The plan covers generics, preferred brands, and non-preferred brands at participating pharmacies.

Are there any prescription coverage changes for 2026?

There are no changes to the prescription co-pays, co-insurance or deductibles for 2026; however, the formulary does change from time to time. Should a formulary change occur, Express Scripts will notify you. More information about the formulary is available here.

Dental Coverage

Do we still have three options to choose from for 2026?

Yes. Although we’ve changed the names, our three dental plans with Delta Dental remain the same: Premier with Ortho (previously Red), Complete with Ortho (previously Blue), and Basic Care (previously White).

What does our dental plan cover?

Coverage includes diagnostic and preventive services, basic services, major services, and, on select plans, orthodontia. Premier with Ortho covers orthodontia for adults and children, while Complete with Ortho covers orthodontia for children only.

Do my preventive dental services count toward my annual benefit maximum?

No. Preventive services such as regular cleanings do not count toward your annual benefit maximum.

Vision Coverage

What type of vision plans are being offered in 2026?

Nemours offers two affordable, associate-paid vision plan options for you and your family through Vision Service Plan (VSP).

What kind of benefits does VSP provide?

Benefits include routine eye exams, lenses, frames, and discounts on other vision services purchased through participating providers. Benefits reset every January 1.

Is there any difference between next year’s vision coverage and this year’s plans?

No. The vision plans and rates remain the same.

Other Benefits

PTO Buyback

Will the PTO buyback happen during this year’s annual enrollment period?

The PTO buyback process and payment will take place from Nov. 29 to Dec. 5, 2025. You will be able to to sell your accrued PTO at 80% of its value if you have at least 88 hours accrued. You can sell up to 100 hours. Once you make your election, it is paid out. You will not have the ability to make changes later. For more information, please reach out to [email protected]. More information will be coming soon.

Life/AD&D, Long-Term Disability, Accident, Critical Illness, Hospital Indemnity Plans

Do I need to re-enroll in these benefits during annual enrollment?

You do not need to re-enroll in these benefits. If you are currently enrolled, your elections will roll over to 2026. If you are not enrolled and wish to enroll in one or more of these benefits, you will have to go online to make your selections.

Make sure your beneficiaries are up to date. It is important that we have this information on file, especially for the Nemours-paid basic life/AD&D benefits offered to benefits-eligible associates. Even if you do not want to make any changes, we encourage you to login and ensure that your beneficiary information is current.

Are there rate changes with these benefits?

No, the rates aren’t changing. However, if your age ends in a zero or a five on January 1, your rates will change as you will be in a new age bracket. The same is true for a covered spouse.

I am not currently enrolled in voluntary life insurance. Can I sign up during annual enrollment?

Yes. You will need to complete an Evidence of Insurability form (EOI) which is a medical questionnaire. Once submitted, this form is subject to Lincoln’s approval.

My family also works at Nemours and is/are eligible for benefits. Can I enroll them as dependents on my coverage?

Double coverage is not allowed. If your spouse and/or child(ren) also work for Nemours and you have family coverage, dependent benefits would not be payable at the time of claim. For families, only one parent can cover the child(ren). Double coverage does not apply if your dependents are less than 0.5 FTE.

Parental Leave

What is Nemours parental leave benefit?

All new parents are eligible for six weeks of paid (100%) parental leave. This is in addition to the short-term disability benefits that birth mothers currently receive.

Employee Assistance

How many visits are allowed under our Employee Assistance Program with Lyra?

Annual visits allowed include eight sessions, per year, per person. This benefit is available to Nemours associates who are full-time, part-time, casual, or temporary and their eligible dependents. Visits may be done in person or virtually.

Flexible Spending Accounts (FSAs), Health Savings Account (HSA) & Income-Based Health Reimbursement Arrangement (HRA)

What happens with my unspent FSA funds at the end of the year?

Any remaining funds in your healthcare FSA up to $660 will roll over into 2026. Any remaining FSA funds above this amount will be forfeited.

- For Dependent Care Accounts, there is no roll over but there is a runout process where you will have until April 30, 2026, to submit for reimbursements for services used in 2025.

- Mass transit and parking funds will be rolled over.

- HSA funds will also roll over.

Do I need to re-enroll in the FSA for 2026?

Yes; you need to re-enroll if you wish to continue the benefit for 2026 (health care, limited purpose, dependent care, parking or transportation).

What happens to my FSA funds if I move to the Low PPO with HSA (previously the Green plan) from one of the other plans?

If you move to the Low PPO with HSA plan (previously the Green plan), any unused health care FSA funds from 2025 will be converted to a limited-purpose FSA and carried over to 2026 up to the IRS limit. The limited-purpose FSA funds can only be used for qualified dental and vision expenses incurred during 2026.

What changes are being made to the employer contributions to the HSA?

The employer HSA contribution amounts are not changing (up to $250 for single and $500 for single plus coverage). Contributions from Nemoursare prorated and deposited twice-monthly instead of as a lump sum.

Will my personal HSA contributions roll over to 2026?

Yes. However, we encourage you to review your current elections to see if they will still meet you and your family’s needs next year. Unlike the FSA, you can make changes to the HSA throughout the year. Please note that your HSA funds will roll over year to year.

What is a Health Reimbursement Arrangement (HRA)?

An HRA is a benefit account owned and funded by Nemours. The funds are used by eligible associates and their eligible dependents to pay for eligible medical expenses. HRA-eligible expenses include medical copays, coinsurance, deductibles, and prescriptions. To get the best use of these funds, we suggest trying to stay in the network as out-of-network services have separate deductibles and coinsurance, which are higher.

Who contributes to an HRA?

It is funded by Nemours. HRAs do not allow associate contributions.

What are the HRA annual contribution limits?

Nemours contributes $1,000 for associates enrolled in individual coverage and $2,000 for associates enrolled in family coverage. Family coverage includes any combination of spouse and/or children.

When is my HRA funded?

Once your application has been approved, you will receive an update in your MyTech ticket. The Benefits team will then work with Nemours Benefits Enrollment to update your eligibility. Once updated, the information will flow over to the appropriate vendors. You will receive a new ID card with “HRA Medical Plan” in the top right-hand section.

Can I get reimbursed from both my HRA and FSA?

You cannot get reimbursed by your HRA and the FSA for the same expense. There is no “double dipping.”

If you have an HRA and FSA, there are some situations that may allow reimbursement from multiple accounts, though not for the same total expense.

How do I use the HRA?

You will need to present your medical ID card to your provider or pharmacy. When the claims are submitted, the funds will be deducted from the HRA account. Any charges outside of the annual contributions will be your responsibility to pay.

If I leave Nemours, can I keep the funds in the HRA?

Associates cannot keep any remaining HRA funds when they leave their employment, whether termination is voluntary or involuntary. However, you can access those funds if you enroll in COBRA and continue your coverage.

Do HRA funds roll over from year to year?

No.

How do I apply for this benefit?

You will need to complete the 2026 Income-based HRA application and submit your 2024 federal income tax return (Form 1040). If you are married and file separate returns, please include yours and your spouse’s 2024 federal income tax returns with this application. Redact or black out any Social Security numbers on your form prior to sending. Applications for 2026 will need to be submitted by Nov. 30, 2025. Any missing documentation may delay the process.

I had the HRA in 2025. Do I need to do anything to have it in 2026?

Yes. You will need to submit a new HRA application and your 2024 tax return(s) to determine your continued eligibility.

Wellness

Am I required to participate in the Nemours Wellness Incentive Program?

No, while we hope you participate for the benefit of your own health and wellness, there is absolutely no requirement that you participate. The wellness program is completely voluntary. Associates who participate in the Wellness Incentive Program can earn incentives, prizes and discounts on health premiums.

What must I do to participate in the Wellness Incentive Program?

Associates who wish to earn a discount on their health premiums need to complete a health assessment, biometric screening and Well-Being Index. Additional incentives may be earned by participating in other health-related activities.

My doctor has told me not to do certain activities, but I want to earn a prize or incentive. Can you make an exception for me?

If you are unable to participate in any specific program offering, you are advised to find out more about possible alternatives by contacting [email protected].

Public Service Loan Forgiveness

What is the Public Service Loan Forgiveness (PSLF) program?

PSLF is a federal program offered by the U.S. Department of Education that forgives remaining balances on direct loans if certain eligibility requirements are met. Eligibility and application information is available here. You may also visit Nemours.tuition.io/register and request an email invitation to participate by entering your work email address.