Health Care Navigation & Advocacy

Quantum Health is our “front door” for benefits. This navigation and advocacy partner will assist with communication, support and understanding of your benefits all while providing a higher level of customer service. Think of them as a one-stop shop for your health and insurance benefits. This means instead of needing to know the contact information for the medical, dental, vision, prescription and all specific programs offered for diabetes, exercise therapy and surgical centers of excellence, you just need to know the contact information for Quantum Health. Quantum will connect you to all the health programs that Nemours offers that may benefit you at the time of need.

Quantum Health is provided to all benefits-eligible associates, at no cost to you and regardless of whether you are enrolled in the Nemours benefits plan. This benefit also covers your eligible family members.

Medical Plans

Nemours offers comprehensive medical coverage for associates and their covered dependents. This includes prescription drug coverage.

There are four levels of medical benefits — Red, Blue, White and Green. Contributions are made on a pre-tax basis. Plan types are described below.

| RED | BLUE | WHITE | GREEN | |

|---|---|---|---|---|

| Plan Type | PPO | EPO | PPO | HDHP with HSA |

- Preferred Provider Organization (PPO): Offers you the freedom to seek care from any provider that you wish. If you seek care from an in-network (participating) provider, you will either pay a co-pay or deductible and coinsurance, and you will not be balance billed. Out-of-network charges will be paid at a lower level, and you will be responsible for any charges over the plan’s recognized charge. You may be balance billed for services performed by an out-of-network (non-participating) provider.

- Exclusive Provider Organization (EPO): An EPO shares essentially the same network as the PPO, but there are no out-of-network benefits associated with the EPO. In that respect, it is similar to an HMO. Emergency services and services that you are unable to choose (such as anesthesiology, ambulance and emergency room) will be covered and paid at the in-network level.

- High-Deductible Health Plan (HDHP) with Health Savings Account (HSA): A high-deductible health plan requires the deductible be met before most benefits are paid. It provides both in- and out-of-network benefits through the PPO. It includes a HSA.

ID Cards

Digital medical ID cards are available within the Quantum Health app or by visiting their website; these cards include both your medical and prescription plan information. Physical cards will be mailed to your home. All family members will have the same unique identifier. ID cards are not re-issued every year, so please keep your cards. If additional ID cards are necessary, please contact Quantum Health directly.

Participating Providers

The Nemours medical plans are administered by Meritain Health and use a custom national Aetna network, so no matter where you live or work, there are in-network providers near you. Meritain Health is a third-party administrator (TPA) and is a subsidiary of Aetna.

Nemours strives to steer care to the best providers including our own facilities. Nemours is equipped to provide the best care for our children and will prioritize appointment times for our associates. Effective Jan. 1, 2025, facility charges for elective/scheduled services performed at the following hospital facilities will be covered at out-of-network benefit level: Children’s Hospital of Philadelphia (CHOP), St. Christopher’s Hospital for Children and Orlando Health Arnold Palmer. Please note this only affects facility charges. Physician provider charges are not impacted by this change. Contact Quantum Health for the exception criteria to allow benefits at these facilities at the in-network benefit level.

To locate participating providers, contact Quantum Health at 844.460.2817 or go to the “Search for Network Providers” tool at www.benefits4nemours.com. Both the homepage and care page have the provider tool. The provider search will link to Aetna POS II (Red, White or Green plans’ network) or Aetna Select (Blue plan’s network) depending on which plan you are enrolled in. You may also call Quantum Health directly to get help with the provider search.

Telemedicine

Nemours associates and their eligible family members have access to virtual online urgent care and behavioral health services — at discounted co-pays — through Teladoc. The service is available 24 hours a day/7 days a week. Teladoc enables scheduled or on-demand video visits between our associates and a care provider. Associates will receive care and a prescription if applicable, just as they would in a regular exam room, except you will have a choice of how to connect – using a computer or mobile device. To connect, please follow these steps:

- Download the Teladoc mobile app or login online

- Register to create an account

- At the service key prompt, enter NEMOURS. This will ensure you get the correct copays and deductibles once your Nemours insurance information is added

Costs of the visits are dependent on the Nemours medical plan chosen:

- Online urgent care visits: $25-$35

- Behavioral online visits: $30-$40

- Green plan – 20% after deductible

Please note: Pediatric telemedicine services are available to all dependents aged 17 years old and younger through the Nemours app on either Apple or Android devices. Pediatric telemedicine visits under the Nemours medical plan are $15 for online urgent care services.

Transparency in Coverage Machine-Readable Files

The Transparency in Coverage Final Rules require our group medical plans to provide information regarding in-network rates for covered items and services, out-of-network allowed amounts and billed charges for covered items and services. You can find those files here.*

In addition to the Aetna network, the following providers are available at no additional cost to you if you are enrolled in one of our Nemours medical plans.

- 2nd.MD is a virtual expert medical consultation and navigation service. Specialists can help with diseases, cancer or chronic conditions; surgeries or procedures; or medication and treatment plans. We connect you with a board-certified, elite specialist for a virtual expert medical consultation via phone or video from the comfort of home.

- Bright Horizons offers eligible associates access to a network of high quality child care centers and in-home care providers for family members of all ages to fill occasional needs when associates’ usual care providers are unavailable.

- Carrum Health provides access to surgical Centers of Excellence that can help connect you with the country’s top surgeons and guide you throughout your surgical journey. More than 100 procedures are covered including hip, knee, shoulder, spine and weight loss surgery. Most, if not all surgery costs are often covered. There is even a travel benefit to offset your travel costs. The reimbursement varies by the type of surgery and the distance needed to travel.*

- Cleo Baby provides expert guidance at critical moments during pregnancy through your baby’s first birthday. You are matched with a Cleo Guide who stays with you through your entire journey. Contact your dedicated expert during family planning and fertility support, when you are expecting your baby, and up to your child’s first birthday to receive emotional support, lactation and sleep training, career counseling/return to work advice and more.

- Gennev is here to assist women to prepare and get through menopause. All the providers are in-network and can assist with sleep and mental health, weight and body changes, heart and temperature changes, hair and skin changes, joint pain and more. Take a free assessment online to find out where you are on your menopause journey and receive customized recommendations and support. Providers are board-certified OB-GYNs with years of experience supporting patients through menopause and midlife. Online articles are available to help with boosting brain health, metabolic health and alternative treatments for those who are unable to receive hormone therapy.

- Hinge Health offers free virtual exercise therapy to support your health needs including: back, knee, hip, neck or shoulder pain; other joint pain; and women’s pelvic health. Work with a physical therapist and health coach anywhere, at your convenience. Best of all, there is no co-pay.

- Progyny is designed for fertility assistance and allows you and your provider to pursue the most effective treatment and provides coverage for two cycles including services and tests. It also includes unlimited clinical and emotional support from a dedicated patient care advocate. This is only available to associates and spouses enrolled in one of the Nemours medical plans and is subject to your deductible and coinsurance.

- SimpliFed provides virtual breastfeeding and baby feeding support. Get help with breastfeeding, latching and positioning, low supply or oversupply, formula feeding, bottle prep, pace feeding and transitions with prenatal baby feeding plan, returning to work and combo feeding.

- Twin Health helps reverse Type 2 diabetes through a personalized program including easy-to-use devices (included) that track your health daily, and a dedicated care team that includes a provider, nurse and health coach. There is no cost to you for this benefit. Learn how other Nemours associated have benefited in this testimonial.

* Eligible associates enrolled in the Green plan using Carrum Health: Individuals enrolled in our high-deductible plan must first meet IRS minimum required deductibles (for 2025, the minimum deductible for individual coverage is $1,650 and for family coverage is $3,300), but co-pays and coinsurance will be waived. Per IRS rules, a portion of any covered travel expenses will be reported as taxable income.

Choosing the Right Medical Plan

Benefits are an important part of your total compensation at Nemours. Each associate is responsible for reviewing the information provided by Nemours, so that you can make an informed decision about your benefits. To help you choose the right benefits for you and your family, Nemours offers Precision Benefits, a customized decision support tool.

When you log in to enroll in your benefits, you will notice a new decision support feature called Precision Benefits. The first time you access Precision Benefits, you will need to authorize the use of your healthcare claims to help give you recommendations by choosing “I authorize the use of my claims data.” This authorization allows the tool to make medical plan recommendations based on your actual claims history through one of Nemours’ medical plans. This history can go back three years. If you are a new hire and do not have claims available for the system to use, there is still logic to help guide you through the decision process. You will see a slightly different message explaining why your process may be a little different.

This feature is voluntary, and you can withdraw your authorization anytime.

If you choose not to authorize the use of your claims, you will be taken to the standard enrollment flow. This allows you to continue to use the decision tool. However, you will have to answer questions, and the tool will provide a recommendation based on your answers.

Benefits Summary — Red, Blue and White Plans

View the latest summary chart for Red, Blue and White plans. Please note: Nemours offers an income-based health reimbursement account (HRA) for eligible associates enrolled in the Red, Blue or White plans. Details on the HRA are available below.

For services that require coinsurance, this applies after the deductible, with the exception of prescription drugs.

Income-Based Health Reimbursement Arrangement (HRA)

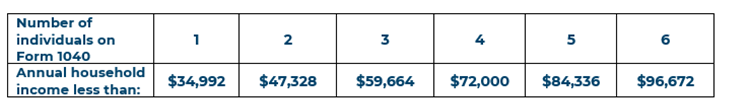

This benefit is used to help eligible associates and their family members pay for co-pays, deductibles, coinsurance and prescriptions. Nemours will fund up to $1,000 for single and $2,000 for family coverages. Since this is funded by Nemours, associate contributions are not permitted and unused funds do not roll over year to year. This HRA is available for associates who meet household income limits (see below) and are enrolled in either the Red, Blue or White plans. Associates enrolled in the Green plan and SAVI are not eligible for this benefit. Associates must complete an application and provide the previous year’s tax return. For 2025, we will need your 2023 tax information. If you are married and file separately, we will need both tax returns. Once you have everything you need, go to MyTech and search for HR Help Center. From there you will be able to create a ticket for the benefits department. Upload your application and taxes to your ticket. If you have questions, please reach out to the HR Solutions Call Center at 877.458.9699. Additional information included in the FAQs on this site.

Benefits Summary — Green Plan

The Green plan is a high-deductible health plan (HDHP) with a health savings account (HSA). You may enroll yourself, your spouse and your dependents in this plan.

The Green plan is a PPO, with both in- and out-of-network medical benefits. It uses the same Aetna network of participating providers as the other Nemours plans. Coverage includes office visits, diagnostic X-ray and laboratory, hospital, surgical, urgent and emergency care, mental health and many other services. In-network preventive care, including routine mammograms, is covered at 100%. Unlike the other Nemours medical plans, you pay 100% of non-preventive medical services until you meet the plan’s annual deductible.

The Nemours prescription drug benefits are administered by Express Scripts. In the Green plan, most prescriptions are covered at 80% after your deductible; however, the plan also covers certain generic preventive medications (on the Standard Plus list) for a $10 co-pay. These are preventive medications not already covered at 100% and include medications for many chronic conditions including asthma and diabetes.

View the latest summary chart for the Green plan.

Health Savings Account

The Green plan also includes an HSA to which you and Nemours may contribute. The HSA is administered by HealthEquity. The Nemours contribution is up to $250 for an individual or $500 for a family. The Nemours contribution is made semi-monthly. You may also make pre-tax contributions to the plan through payroll deductions or contribute tax-deductible amounts directly into your account. Requested reimbursements cannot exceed your account balance.

The total contribution allowed in 2025, including both Nemours and associate contributions, is $4,300 (individual) or $8,550 (family). If you are age 55 or older, you may contribute an additional $1,000 to the account annually. Please contact HealthEquity at 866.346.5800 or visit their website for more information.

You are eligible to contribute to the HSA if:

- You are enrolled in a qualified high-deductible health plan

You are NOT eligible to contribute to the HSA if:

- You are covered by your spouse or have retiree coverage at another employer

- You are covered under a parent’s plan

- You are claimed as a dependent on another person’s tax return (except for your spouse)

- You are enrolled in an employer or spouse’s general purpose FSA

- You are enrolled in Medicaid, Medicare or TRICARE

- You are enrolled in an individual or Marketplace plan

Unlike traditional FSAs which are ‘use-it-or-lose-it,’ unused funds contributed to the HSA is yours to keep even if you are no longer employed by Nemours or if you move to another one of the medical plans. Associates who enroll in the Green plan may also sign up for a limited purpose FSA which is only for dental and vision expenses and follow the same rules as the traditional FSA, such as “use it or lose it.”

Prescription Drug

How to Use the Program

Retail Prescriptions: Take your prescription(s) to any participating Express Scripts network pharmacy. Present your Quantum Health ID card. You may purchase up to a 34-day supply of retail prescription drugs. If your doctor authorizes a refill, the same supply limitation will apply when your prescription is refilled. There may be prior authorizations, quantity limitations or step therapy required on certain prescription drugs. Drugs purchased from non-participating pharmacies will not be covered. Contact Quantum Health for a list of participating pharmacies or search online for a participating pharmacy.

The cost of prescriptions will vary, depending on whether you receive a generic drug, a preferred-brand drug or a non-preferred brand name drug. Express Scripts updates their formulary throughout the year. We encourage you to review the latest Express Scripts formulary lists and other information linked below.

- 2025 Rx Plan Overview

- 2025 Rx Booklet

- 2025 ACA Preventive Medications

- 2025 Standard Plus Preventive Drug List (for Green plan)

- 2025 Specialty Medications

- 2025 National Preferred Formulary Exclusions

- 2025 National Preferred Formulary Exclusion List Changes

Definitions

Generic

Generic drugs have been approved by the U.S. Food and Drug Administration (FDA) for quality and safety and are absorbed in the same way as a brand name drug.

- Chemically Equivalent: have the same active ingredients, in the same quantities, as a brand name drug. The only differences are fillers and dyes.

- Therapeutically Equivalent: treat the same conditions as brand name drugs, but do not contain the same active ingredients.

Preferred Brand

Preferred brand name drugs are drugs still protected by patents (meaning no chemically equivalent generic is available). The FDA has approved these higher-cost drugs after trials show they are safe and effective. When a generic drug is introduced for a preferred brand name drug, the brand name will automatically move from preferred brand to non-preferred brand. Check our carrier links regularly for updates.

Non-Preferred Brand

Associates will pay the most for non-preferred brand name drugs (which are listed in this tier for a variety of reasons). These drugs are non-preferred because there are other, lower-cost brand name drug(s) that are just as effective.

Generic Preferred Program

If you have a prescription for a brand name drug, and a chemically equivalent generic drug is available, you will have the option of choosing either the generic equivalent or the brand name drug. If you choose the brand name drug, you will pay the brand coinsurance or co-pay plus the difference in cost between the generic and the brand name drug.

Maintenance Medications – Smart90

Maintenance medications are ongoing, long-term prescriptions for conditions such as high blood pressure, high cholesterol and diabetes. Smart90 is a program managed by Express Scripts that gives you two ways to get a 90-day supply of your maintenance medications. You can conveniently fill these prescriptions either through home delivery (mail order) from the Express Scripts Pharmacy or from Walgreens, the Smart90 network pharmacy for our plan. Your physician must write the prescription for a 90-day supply.

You are allowed two fills of maintenance medications from other retail pharmacies before you must switch to Walgreens or home delivery. If you continue to use 30-day supplies or fill at a pharmacy that is not part of the Smart90 network, you will pay 100% of the cost of your maintenance medication. Please note that you may fill 90-day prescriptions for maintenance medications without penalty at a Nemours outpatient pharmacy.

For more information regarding the Smart90 program, please contact Express Scripts directly, via their website or toll-free number listed in Key Contacts Info.

Accredo Program

Specialty medications (usually high cost or injectable drugs) must be filled through Accredo, a leading specialty pharmacy, and may require prior authorization. Through the Accredo program, you will have access to:

- A patient care coordinator who serves as your personal advocate and point of contact

- Delivery of your specialty medications directly to you or your doctor

- Supplies to administer your medications — at no additional cost

- Care management programs to help you get the most from your medications

If you are taking a specialty medication, your first prescription fill may be at your normal retail pharmacy. You will then receive correspondence from Express Scripts on how to transfer your prescription to Accredo.

SaveOn SP Program

A specialty pharmacy co-payment assistance program (also referred to as the SaveOn SP Program) is administered by Express Scripts. Please note that while participation in the SaveOn SP Program is voluntary, and must be affirmatively elected by a participant — certain specialty prescription drugs will be considered non-essential health benefits under the plan. If you participate in the SaveOn SP Program, the cost of these specialty drugs to you will be $0. If you do not elect to participate in the SaveOn SP Program, you will be responsible for the copayments of the specialty drugs, which may be significantly increased. Regardless of whether you participate in the SaveOn SP Program, the cost of such specialty prescription drugs will not be supplied toward satisfying your maximum out-of-pocket limit under the plan’s medical options. Additional information regarding the SaveOn SP Program will be made available to you by Express Scripts.

Nemours Outpatient Pharmacies

Associates may also fill prescriptions for themselves and their families at the Nemours Children Hospital, Delaware or at Nemours Children’s Health, Jacksonville. A 90-day supply of maintenance medication can be filled at these Nemours outpatient pharmacies for only two times the applicable co-pay or coinsurance. While the 90-day supply will be the most cost-effective option, in most cases, there are some exceptions due to certain retail pharmacy pricing arrangements.